Direct materials price variance defines actual quantity as the actual quantity purchased. Direct materials quantity variance defines actual quantity as the actual quantity used. As our analysis notes above and as these entries illustrate, even though DenimWorks had actual variable manufacturing overhead of $156, the standard amount of $160 was applied to the products. Accountants might say that for the month of February 2023, the company overapplied variable manufacturing overhead. A variance is the difference between an actual measured result and a basis, such as a budgeted amount. In many accounting applications, a variance is considered to be the difference between an actual cost and a standard cost.

Using 3 Ledger Accounts

A manufacturer must disclose in its financial statements the amount of finished goods, work-in-process, and raw materials. Accounting professionals have a materiality guideline which allows a company to make an exception to an accounting principle if the amount in question is insignificant. As with material what is adjusted gross income variances, there are several ways to perform the intrinsic labor variance calculations. Or, one can perform the noted algebraic calculations for the rate and efficiency variances. The equation subtracts standard from actual first, then multiplies by standard price and sums across all inputs.

5.1 Differences Between Direct Materials and Direct Labor

Here on the cost variance side, I focus on the price and quantity variances. In the below discussion, I usually ignore volume variance and start with flexible budget numbers to begin with. Otherwise that variance would get in the way of evaluating performance. Later in Part 6 we will discuss what to do with the balances in the direct labor variance accounts under the heading What To Do With Variance Amounts. In February DenimWorks manufactured 200 large aprons and 100 small aprons. The standard cost of direct labor and the variances for the February 2023 output is computed next.

9 Appendix: Recording Standard Costs and Variances

This only happens when inventory is recorded at its standard cost, rather than its actual cost. If such is the case, and there is a variance from the standard cost, how do you account for the variance? The answer depends upon how well standard costs have been constructed. If the standards are well-researched and have been updated recently, any variances should be outside of the costing expectations of the business, and so should be recognized in the current period. Since the original transaction was already recorded at its standard cost, this means that there is no need to account for the variance. If the $2,000 balance is a credit balance, the variance is favorable.

That’s because the “standard costs versus normal costs versus actual costs” decision answers a different question than the “job-order costing versus activity-based costing versus process costing” decision. Second, the two variances, added together, do not always equal the total difference between actual cost and flexible budget cost, since actual quantity purchased is usually different from actual quantity used. So the diagram above better shown as follows, at least for cost variances. (The asterisk reflects how the flexible budget’s “budgeted quantity” is how much input would have been budgeted at the actual number of units produced). Direct labor and direct material variances largely follow the same pattern demonstrated by the revenue price and quantity variances. The credit goes to several differentaccounts depending on the nature of the expenditure.

- Second, it is more likely that responsibility for overhead costs, even after additional investigation, is spread across several managers and/or departments.

- For the remainder of our explanation, we will use a common format for calculating variances.

- Sales price variance measures that difference by comparing what budgeted revenue would have been if the firm knew how much actual revenue.

- These T-accounts are debited or credited as costs are applied to WIP.

- Work-in-process inventory reflects the standard quantity of direct materials allowed at the standard price.

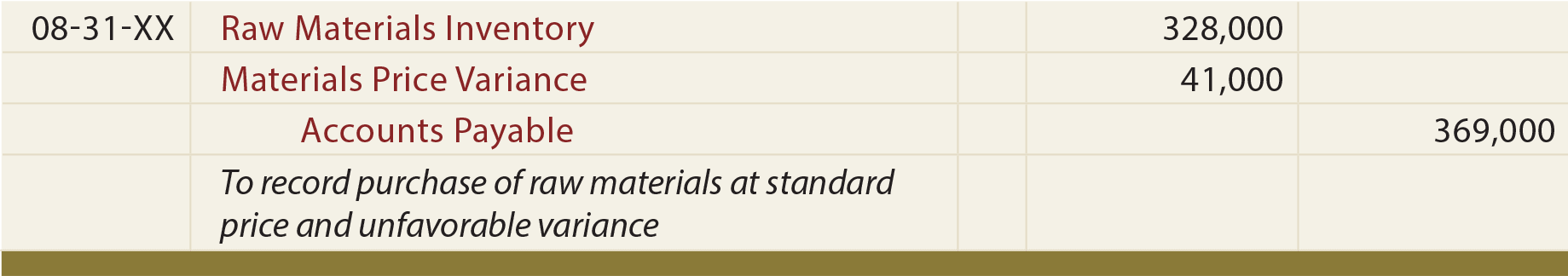

Did the firm sell a product for a higher or lower average price than it budgeted? Sales price variance measures that difference by comparing what budgeted revenue would have been if the firm knew how much actual revenue. Note that the entry shown previouslyuses standard costs, which means cost of goods sold is stated atstandard cost until the next entry is made. Note that the entry shown previously uses standard costs, which means cost of goods sold is stated at standard cost until the next entry is made. The transactions with regard to accounting for material price variance would be.

If a firm is going to subdivide variances from a budget into actionable chucks of information, then it has to use the building blocks that were used to develop the budget in the first place. But total budget variance, the only variance I’ve introduced thus far, could be caused by hundreds, thousands, even millions of things. Managers are hardly any closer to knowing how to improve profits simply by knowing total budget variance. Variances are usually expressed as absolute values followed by either “unfavorable” or “favorable,” based on whether the variance pushes firm profit lower or higher, respectively.

Since variable overhead is consumed at the presumed rate of $10 per hour, this means that $125,000 of variable overhead (actual hours X standard rate) was attributable to the output achieved. Comparing this figure ($125,000) to the standard cost ($102,000) reveals an unfavorable variable overhead efficiency variance of $23,000. However, this inefficiency was significantly offset by the $20,000 favorable variable overhead spending variance ($105,000 vs. $125,000). Review the following graphic and notice that more is spent on actual variable factory overhead than is applied based on standard rates. This scenario produces unfavorable variances (also known as “underapplied overhead” since not all that is spent is applied to production).

A good manager will want to explore the nature of variances relating to variable overhead. It is not sufficient to simply conclude that more or less was spent than intended. As with direct material and direct labor, it is possible that the prices paid for underlying components deviated from expectations (a variable overhead spending variance). On the other hand, it is possible that the company’s productive efficiency drove the variances (a variable overhead efficiency variance). Thus, the Total Variable Overhead Variance can be divided into a Variable Overhead Spending Variance and a Variable Overhead Efficiency Variance. Let’s say the standard quantity is actually 6 ounces, that is, given the number of finished goods units produced, the budget would predict that the company use six ounces.

No Comments